Non-Fungible Tokens (NFTs) have gained popularity in recent years as a new way of creating, selling, and trading digital assets. While NFTs have been used primarily in the art world, they have the potential to transform other industries as well, including crowdfunding and startup funding. In this article, we will explore the potential of NFTs for crowdfunding and startup funding, including their benefits, applications, and challenges.

Introduction

In this section, we will provide an overview of NFTs and crowdfunding, and how they are related. We will also discuss the potential benefits of using NFTs in the context of crowdfunding and startup funding.

What are NFTs?

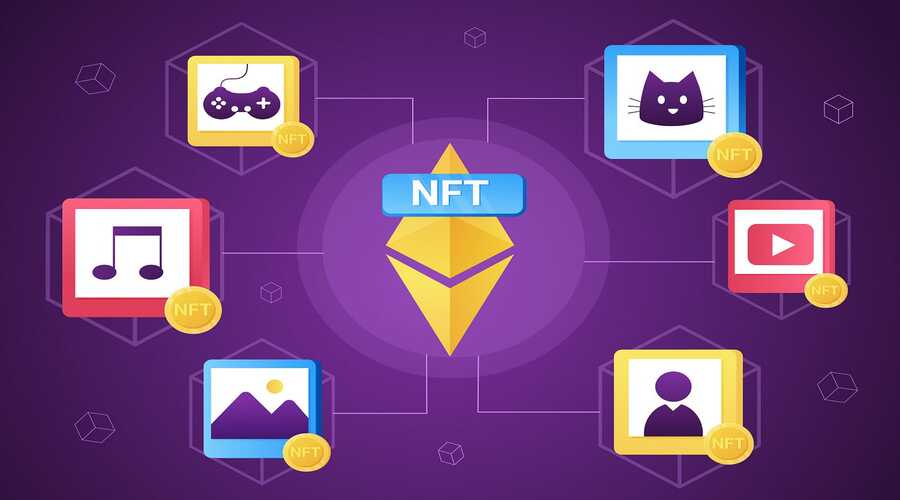

NFTs, or Non-Fungible Tokens, are unique digital assets that use blockchain technology to verify ownership and authenticity. NFTs can represent anything from artwork to virtual real estate, providing a secure and transparent way to buy, sell, and trade digital assets.

What is Crowdfunding?

Crowdfunding is a method of raising capital from a large number of people through online platforms. Crowdfunding can be used for a variety of purposes, including startup funding, creative projects, and charitable causes.

NFTs in Crowdfunding: Potential Benefits

NFTs can provide a new way to raise capital through crowdfunding by enabling the creation of unique and scarce digital assets. NFTs can also provide a new form of digital ownership and value creation, enabling investors to participate in the success of a project or startup.

Applications of NFTs in Crowdfunding

In this section, we will explore some of the potential applications of NFTs in the context of crowdfunding. We will discuss how NFTs can be used to create unique and valuable digital assets, enable new forms of investor participation, and support the growth of startups and projects.

Unique and Valuable Digital Assets

NFTs can enable the creation of unique and valuable digital assets in the context of crowdfunding. For example, a startup could create a one-of-a-kind virtual product and sell it as an NFT, providing investors with exclusive ownership and control over the asset. This can create a sense of rarity and uniqueness, driving demand and increasing the value of the asset.

New Forms of Investor Participation

NFTs can enable new forms of investor participation in the context of crowdfunding. For example, a startup could create NFTs that represent equity in the company, enabling investors to participate in the success of the company in a more direct way. This can create a sense of ownership and commitment among investors, driving engagement and participation.

Supporting Startups and Projects

NFTs can also support the growth of startups and projects by providing a new way to raise capital and engage with investors. By using NFTs, startups and projects can create unique and valuable digital assets that can be used to attract investment and support the growth of the company.

Challenges and Limitations

While the potential applications of NFTs in crowdfunding and startup funding are vast, there are also challenges and limitations to consider. In this section, we will discuss some of these issues.

Accessibility and Inclusivity

One of the main challenges of using NFTs in crowdfunding and startup funding is ensuring accessibility and inclusivity for all investors. NFTs and blockchain technology can be complex and require significant resources to operate, which can create a barrier to entry for many people.

Legal and Regulatory Issues

The use of NFTs in the context of crowdfunding and startup funding raises legal and regulatory issues, such as securities laws and tax implications. The ownership and transfer of digital assets can be complex, and there may be legal gray areas that need to be addressed.

Market Volatility

The market for NFTs and digital assets can be highly volatile, which can pose a risk for investors and startups. The value of NFTs can fluctuate rapidly, and it can be difficult to predict the long-term value of a particular asset. This can make it challenging for startups to raise capital and for investors to make informed investment decisions.

Technical Limitations

The current state of blockchain technology presents technical limitations that can hinder the adoption of NFTs in crowdfunding and startup funding. For example, the processing and storage requirements for blockchain technology can be high, which can limit the size and complexity of digital assets that can be created and traded.

Case Studies: NFTs and Crowdfunding

In this section, we will examine some case studies of NFTs and crowdfunding in action.

Seed Club

Seed Club is a decentralized incubator that uses NFTs to enable community-driven startup funding. Investors can purchase NFTs that represent ownership in a portfolio of startups, providing a new form of digital ownership and participation in the success of the portfolio.

Rarible

Rarible is a marketplace for buying and selling NFTs, including artwork, collectibles, and digital assets. Rarible has also launched a crowdfunding platform that enables creators to raise funds through the sale of NFTs.

SuperRare

SuperRare is an online marketplace for buying and selling rare and collectible digital art. SuperRare has also launched a crowdfunding platform that enables artists to raise funds for new projects through the sale of NFTs.

Conclusion

In conclusion, NFTs have the potential to transform crowdfunding and startup funding by enabling the creation of unique and valuable digital assets, new forms of investor participation, and support for the growth of startups and projects. However, there are also challenges and limitations to consider, such as accessibility and inclusivity, legal and regulatory issues, market volatility, and technical limitations. As NFTs and blockchain technology continue to evolve, it is important to address these issues and work towards creating a more sustainable and inclusive digital ecosystem.

Pranav is a tech, crypto & blockchain writer based in London. He has been following the development of blockchain technology for several years.